[ad_1]

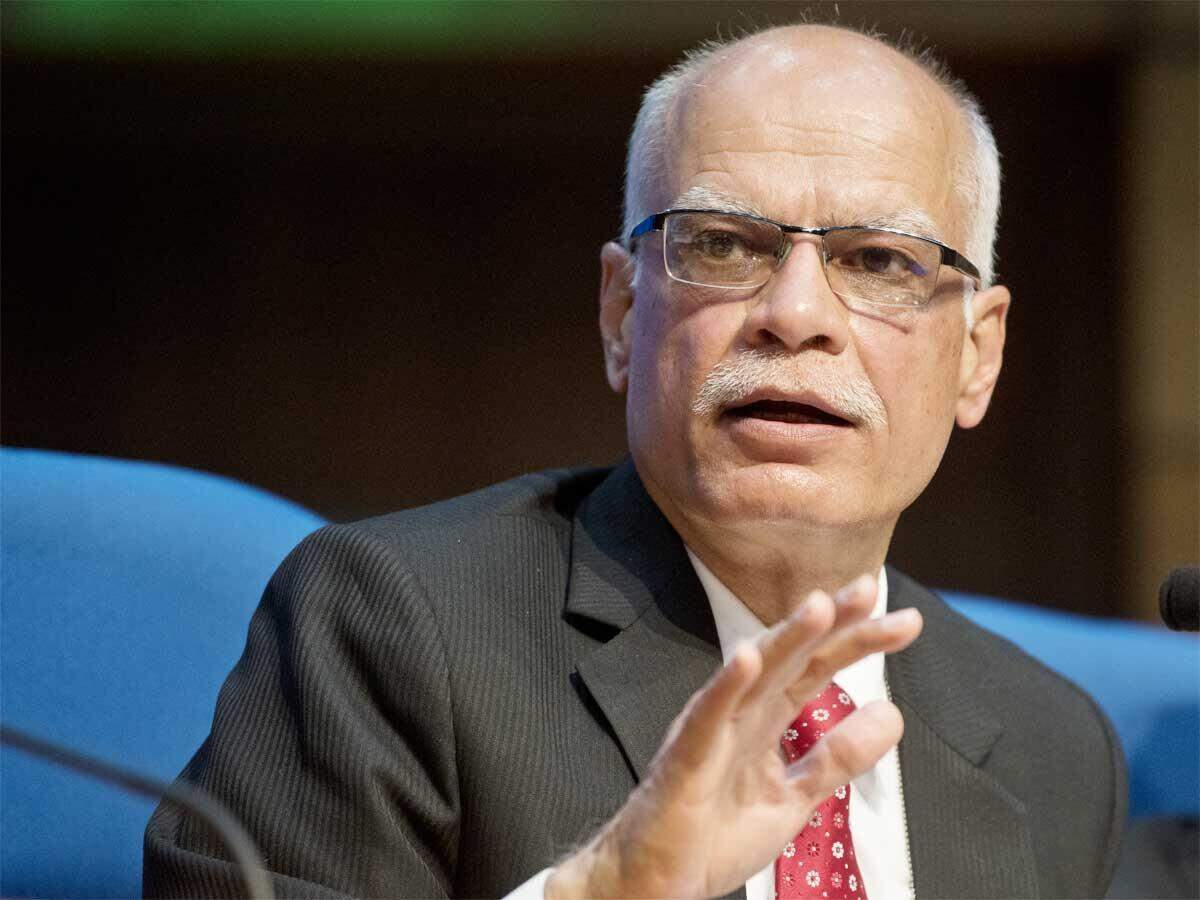

New Delhi: The federal government is anticipating a “very, very strong” tax income within the present fiscal on the again of better-than-expected company sector efficiency, Income Secretary Tarun Bajaj mentioned on Wednesday. Acknowledging that top GST charges are impacting the automotive sector, Bajaj mentioned the GST Council would take a look at options to convey down charges that are very excessive, take out sure objects from the tax-exempt class and proper the inverted responsibility construction.

“Once I take a look at the present first quarter, the outcomes have began coming and (tax) revenues have additionally began coming. The primary advance tax is over, the TDS date is coming and going, I see a really, very strong tax income that’s coming.

“It isn’t that we’ve elevated the taxes, or we’ve develop into extra intrusive and we’re coming to you asking to pay extra taxes… the completely happy factor behind that is, maybe the company sector is doing higher than what we had anticipated it to. So, it’s a excellent factor for the economic system,” Bajaj mentioned at a CII annual session right here.

The web direct tax assortment within the April-June quarter of the present fiscal stood at over INR 2.46 lakh crore, as towards over INR 1.17 lakh crore collected throughout the identical interval final fiscal (2020-21).

Web Oblique Tax (GST and Non-GST) income assortment within the June quarter of present fiscal was at INR 3.11 lakh crore.

Web GST assortment through the quarter was over INR 1.67 lakh crore, which is 26.6 per cent of the funds estimate of INR 6.30 lakh crore for full 2021-22 fiscal. The web GST assortment contains Central GST + Built-in GST + Compensation cess.

With regard to Items and Companies Tax (GST), Bajaj mentioned there are plenty of objects on which tinkering of tax charges is perhaps wanted, however there’s a have to first stabilise the regime.

“On tax charges, I fairly agree once you discuss of the automotive sector. You might be speaking about two-wheelers, however I’d say on the four-wheelers we not solely cost 28 per cent, but additionally cost cess which is way more and as I see it, it is going to proceed for a couple of extra years.

“All that has a damaging affect on the trade. I acknowledge that, however I do not know the right way to clear up that situation,” Bajaj mentioned.

He additional mentioned that though GST charges have come down at macro stage, there was a necessity to have a look at options to convey down charges that are very excessive.

“Charges have come down at macro stage, sure, in a couple of sectors they could have gone up. However we’ve to have a look at options to convey down charges that are very excessive and take out sure objects that are below exempted objects, inverted responsibility constructions, we have to try this and I am positive, within the coming GST council assembly once we give this agenda, I’m positive we will get these issues,” the Secretary added.

Asking personal corporations to take a position extra, Bajaj mentioned animal spirit is lacking from the company sector.

“I do not see personal funding occurring that a lot… for a sustained and long-term progress of the economic system we would like you individuals to return ahead to take a position, manufacture, begin companies and please inform us what’s it that you simply require from us,” Bajaj mentioned on the CII annual session.

He additional added that, “one message that I’ve given to my officers right here is do not take a look at each penny. I am okay to lose a pound if the economic system provides me 10 kilos. That’s the angle that I’d say the income division can be working and ought to be engaged on that.”

Final week, the federal government introduced in a invoice, which seeks to nullify retrospective tax calls for raised on corporations. The invoice proposes to scrap the tax rule that gave the tax division energy to go 50 years again and slap capital features levies wherever possession had modified fingers abroad however enterprise property had been in India.

The 2012 laws was used to levy a cumulative of INR 1.10 lakh crore of tax on 17 entities, together with UK telecom big Vodafone, however substantial punitive motion was taken solely within the case of Cairn.

The Taxation Legal guidelines (Modification) Invoice, 2021 seeks to withdraw tax calls for made utilizing a 2012 retrospective laws to tax the oblique switch of Indian property and in addition refund the quantity paid in these circumstances with none curiosity.

On elevating tax to GDP ratio, Bajaj mentioned climbing charges to extend tax assortment shouldn’t be an answer and as a substitute the tax-base needs to be expanded to convey extra individuals below the tax internet.

He mentioned in India, sadly, there are solely sure segments of individuals which are within the tax internet and I believe that’s considered one of the explanation why many of the taxes are coming from sure lessons or classes of taxpayers.

“The rise in tax buoyancy in present yr can also be because of sure quiet steps taken by I-T division,” he mentioned including that the federal government is making an attempt to rope in a big a part of casual sector, or non-corporate and non-salaried sector by bringing in a few of their transaction or companies into focus and making an attempt to seize that.

“The actual fact that now we’re matching the GST return with ITR is making plenty of them pay taxes. That’s the reason I used to be saying that with out elevating tax charges, tax buoyancy is up.

“I’m really trying ahead to increasing that effort. I do not need to tax the company sector which already pays taxes within the nation, and contributes a significant a part of taxes within the nation,” he added.

Additionally Learn:

[ad_2]

Source link