[ad_1]

Opinions expressed by Entrepreneur contributors are their very own.

As I used to be speaking to considered one of my early-stage founders about company governance rules, I spotted that what I used to be sharing with him is not widespread information. Early-stage founders at all times right here “search good capital,” however I spotted that founders do not actually perceive the total depth of that assertion or why it’s so necessary to be strategic when elevating capital, particularly within the early rounds (pre-seed, seed and Collection A).

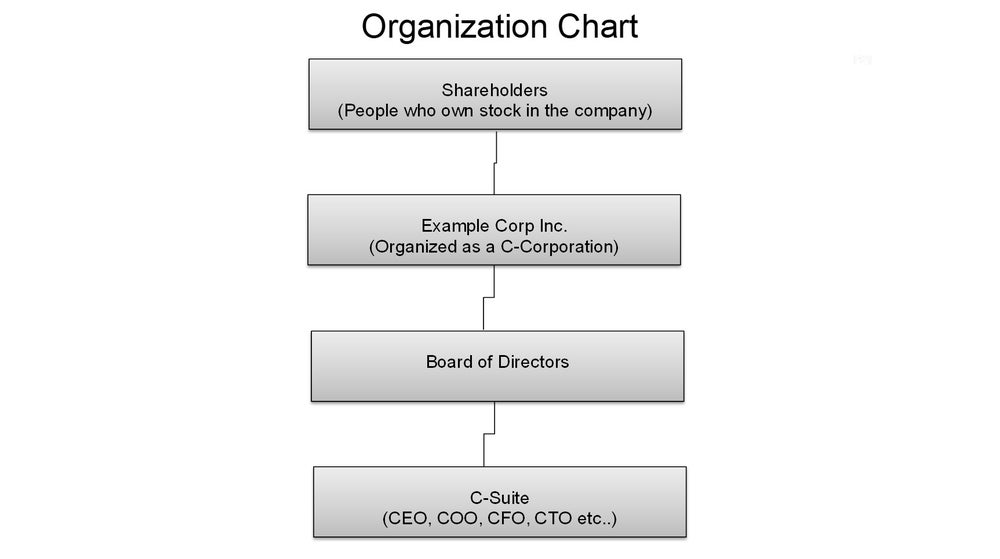

Let’s begin by altering the phrase “search good capital” to “search synergistic capital.” To crystallize the purpose of why searching for synergistic capital is so necessary for early-stage founders, I wish to cowl some key factors of company construction and governance, as understanding this from that lens will higher show you how to see the significance of the subject. Observe the organizational chart I’ve created beneath:

Picture Credit score: Fredrick D. Scott, FMVA

It isn’t the prettiest org chart I’ve ever carried out, however it’ll illustrate this level properly. An important takeaway from the chart above is knowing how the hierarchy works. Ranging from the underside of the chart and dealing our approach up:

C-suite executives

C-suite executives are thought-about “day after day” managers of the enterprise. They’re chargeable for overseeing and ensuring the corporate and employees are working throughout the mission and imaginative and prescient, as outlined by the board of administrators (with enter from the C-Suite). They be sure the corporate is working, in all features, as effectively as potential and hitting the varied progress metrics set to make sure the corporate is producing extra income 12 months after 12 months. Most significantly, it’s essential to perceive that an organization’s C-suite works to the desire and pleasure of the board of administrators. It is a key level of understanding, and you will note why in a bit.

Associated: The Fundamentals of Elevating Capital for a Startup

Board of administrators

The following degree up within the hierarchy is the board of administrators. Their job is to supply oversight of the C-suite, to implement macro coverage, governance paperwork and tempo. Most significantly, their job is to guard shareholder pursuits by insuring two issues:

One, that the C-suite is working in an environment friendly method and steering the corporate within the path that, within the board’s opinion, will result in the absolute best likelihood of accelerating progress, income and revenue margins 12 months after 12 months.

And two, that there are correct guardrails in place that govern the best way the C-suite operates and supply ample danger mitigants in opposition to “irregularities” and/or irrational methods that, within the board’s opinion, would erode shareholder worth. Extra importantly, the board, usually, has the power to effectuate swift motion in opposition to a C-suite government within the occasion that they really feel such motion can be in the very best pursuits of the corporate, and by extension, the shareholders.

A very good instance of this performed out fairly publicly at WeWork when the now-former CEO, Adam Neumann, was ousted from the very firm he based by the corporate’s board of administrators, as a result of (in brief) they felt that his actions have been not serving the very best curiosity of the corporate, and by extension, the shareholders.

Shareholders

Let’s take a deeper have a look at them. Shareholders (also referred to as stockholders) are the homeowners of an organization. They purchase inventory within the firm, and every inventory they purchase represents a share of possession within the firm. How large or small that share of possession is dependent upon how a lot inventory the corporate points and what number of of these shares an individual or one other firm (each of that are thought-about traders) buys. Let us take a look at two very, quite simple examples of this:

Firm A has issued 100 shares of inventory. An investor decides they wish to purchase 10 shares of Firm A’s inventory. That investor now owns 10% of Firm A.

Firm B has issued 1,000 shares of inventory. An investor decides they wish to purchase 10 shares of Firm B’s inventory. That investor now owns 1% of Firm B.

Word that these are, once more, quite simple examples, and issues can get fairly a bit extra advanced than that when taking a look at an organization’s fairness construction. Nonetheless, the aim of those examples is as an instance the purpose that shareholders are part-owners of the corporate.

Associated: Ought to You Pitch Your Startup to Early-Stage Buyers?

The significance of searching for synergistic capital

With the above factors established, let’s study why searching for synergistic capital as an early-stage firm is crucially necessary. As outlined within the above dialogue, it might appear to be everyone seems to be working in direction of the identical finish: To earn more money for the corporate, and in flip, make more cash for the shareholders of the corporate. Within the ideally suited scenario, everyone seems to be aligned utterly in that endeavor. Nonetheless, issues are hardly ever ideally suited in the true world, particularly for early-stage corporations. Whereas the last word objective will be the identical (to earn more money), there generally is a divergence of opinions amongst senior executives and the board of administrators on one of the simplest ways to go about reaching the last word objective. This divergence is the place bother can start and the place failure can ensue for early-stage corporations and/or their founders.

The difficulty lies in how the vast majority of early-stage corporations go about elevating capital. Usually, due to the very nature of being a startup enterprise and all of the obstacles that come together with that, founders who’re attempting to lift capital for his or her companies (particularly within the early rounds), are so determined for capital that they’re keen to take it from anybody who’s keen to provide it.

The problem with taking this strategy is that, loads of occasions, your earliest traders (particularly these with expertise in early-stage investing) will doubtless require that they’re given a board seat as a situation to supplying you with capital. The rationale from an investor’s standpoint is that they need to have the ability to train oversight on the corporate — and by extension — using the capital they provide the corporate, to make sure that the capital is getting used correctly and effectively.

When a founder understands this reality, what looks like such a minor factor (freely giving a board seat) is not so minor anymore. Keep in mind, the board’s job is to guard shareholders’ pursuits and do what they really feel goes to drive shareholder worth the quickest. Their perception on how that may be carried out could not align with a founder’s imaginative and prescient for the corporate.

Now, loads of founders studying this text will say “Nicely I personal most of my firm’s shares so it is a non-issue for me.” That could be true TODAY, nevertheless, as you elevate increasingly more capital, you need to give away increasingly more possession of the corporate (often called dilution), so in brief: The extra you elevate, the much less you personal. With out correct planning, it’s simple to seek out your self, as a founder, within the minority possession place of the very firm you began.

Couple that with a board of administrators that does not absolutely see eye to eye with the best way you might be operating the corporate, and you possibly can simply end up on the surface wanting in (which means fired). Even if you’re the chairman of the board, it would not matter, you’ll be able to nonetheless be outvoted by the remainder of your board.

Enjoyable reality: Do you know that, in response to Roberts Guidelines of Order (the gold normal for tips on how to conduct board conferences), the chairman of the board would not even get to vote except it’s to interrupt a tie?!

This is the reason searching for synergistic capital is so necessary for early-stage founders. You wish to be certain that the people who find themselves investing in you and your organization are absolutely aligned with you and your imaginative and prescient. You need those that imagine in you that will help you add accretive worth to your organization by the use of expertise, relationships,and time funding into your growth as a founder and CEO (and into the event of the corporate itself). For my part, something wanting it is a recipe for eventual catastrophe (keep in mind 94% of enterprise capital-backed corporations finally fail).

The perfect likelihood a founder and their firm must succeed is by being strategic and intentional in each facet of their enterprise endeavors, and that’s particularly necessary within the facet of elevating capital. Founders must do not forget that enterprise capital would not work with out corporations to put money into, so it is very important keep in mind this level, and lift capital as a founder, not as a pauper!

Associated: Elevating (Sensible) Capital And Why It is Not Simply About The Cash

[ad_2]

Source link